How to Continue Making Money in Another Likely Down Year for Markets, Part I

I had to split this article into two parts, because it exceeded the allowable limit of a substack article. Here is Part I. Part II will containt the conclusion.

In 2022, I produced significant returns on assets that were completely ignored and touted by the mainstream financial media as “uninvestable” because mainstream media journalists never understand how to make money during bad markets. You may have heard in the past that you want to buy assets that are completely ignored by everyone else because this is when they will possess their best valuations. However, as you well know by now, the entire thesis of all the stocks Cathie Wood purchased in 2022 for her ARKK ETF was that they were heavily undervalued and that the market was not giving any credit for the strength of companies she identified as the best companies of 2022. Of course, I avoided all these stocks ignored by many others because I thought they were awful as turned out to be the case. Thus, the narrative that identifying the most ignored stocks by other investors makes them a strong buy is not a correct narrative. The 30 most-ignored stocks she picked in her ARKK ETF still tanked by an average of more than 65% while the 30 most-ignored stocks I selected last year returned an average gain of over 69%.

As I’ll illustrate through the remainder of this article, using a few charts, in these terrible investment markets, not only is it necessary to identify assets that no one else identifies for significant yield potential well before anyone else, but one also has to get the timing of when to buy and sell correct. I’ll demonstrate below, that with improper timing, one would have suffered big losses investing in the same assets that I championed last year. And moving forward in 2023, at least for the next few years, I believe that one will need to time the market correctly to continue to make decent realized profits in these markets, no matter if you’re investing in German, Australian, Canadian, UK, Brazilian, Russian or US markets.

If you’re familiar with the concept of flow, you will understand my thesis presented in this article. Timing, as I proved last year, is where the profits are at. This is how to make profits without fighting the market. Those that lost a great deal of money last year did not incorporate the concept of flow into their investment strategies. Instead, they stuck with conventional strategies that were tantamount to constantly fighting the market, like pushing a giant boulder up a hill. To make money, go with the strategies that do not require constant fighting and struggle.

In a year called by all traditional investors as one of the worst years in recent history, with nearly all sectors of traditional stocks as well as bonds down significantly on the year, there is always opportunity, incorporating the concepts of flow, not just to produce small positive yields but also very large double-digit yields. Furthermore, despite ample historical documented evidence of both US Central Bank and BOJ (Bank of Japan) bankers perpetually interfering in stock and bond markets to artificially push both higher for decades (as I will outline in my upcoming skwealthacademy), I very explicitly stated on this platform at the start of 2022, that such fraud always eventually fails. In fact, I stated here in January 2022 that a massive US stock market crash was coming, and that “Jeremy Grantham’s predicted 50% US stock market crash [was] way too conservative” for the depth of the crash that I predicted would proceed from the beginning of 2022.

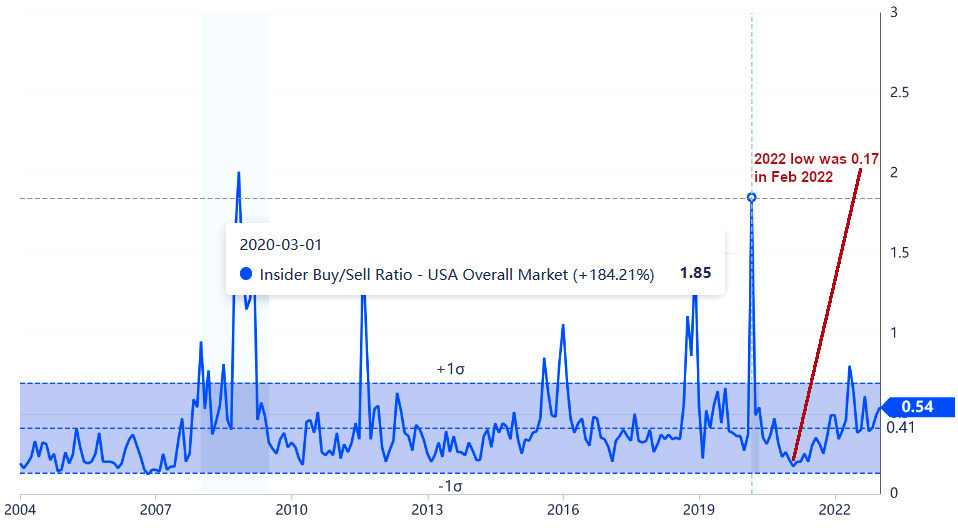

When I made this prediction, I received a lot of pushback from those that stated 2022 would be yet another typical year of stellar returns in the US stock market on the false premise that the US Federal Reserve would continue to blow the Bubble of Everything bigger because “no one can fight the Fed”. While it’s true that no one can fight the Fed’s policies, this is separate from believing that the Fed’s policies will eventually implode in spectacular fashion upon the weight of their own intended stupidity. In years prior to 2022, fighting the Fed would’ve been fighting flow. But in 2022, investing in stock market indexes was the definition of fighting flow. However, if you look at the chart of US insider buys: sells below, you can clearly see that the last time this ratio even approached a bullish ratio of 1:85 to 1 was immediately after the US Central Bankers announced an emergency cut of the Fed Funds rate back to zero in March/April of 2020.

Selling rapidly progressed throughout 2021 as the stock market rose, and for the majority duration of 2022, insiders remained on the sidelines as the insider buys: sells ratio quickly plummeted to a low of 0.17 last February. Though some insiders re-entered the market in 2022, causing the ratio to climb higher for the remainder of the year, insider selling still outpaced buying by a greater than 2:1 margin for most of 2022. Again, this shows how retail investor hopium is always trumped by insider knowledge of markets as if one simply followed this index, it would have forecast a very difficult investment environment for all of 2022.

And this was even the case for PM mining stocks. Here are two charts below in which I’ve drawn a horizontal green line to illustrate that both asset classes (gold and silver mining stocks) ended the year last year much lower than where they began. But insiders typically never try to time the market because they think it can’t be done.

Yet, investing in this asset class throughout 2022, I consistently yielded double-digit, and often high double-digit realized yields simply by timing the market. The first thought that goes through the minds of 99.9% of all investors, because they are MBA trained and Wall Street educated and never learned any proper investment strategies to earn significant realized profits during difficult markets is that it is pure insanity to invest in markets represented above. However, their thought process is driven by the following. In bullish markets, a rising tide lifts all boats, and in the process of lifting all boats, produces many fools that conflate their luck for skill. But in a receding tide, as the one we experienced last year, the “lucky” during bull markets lose every bit as much, if not more, than overall stock market indexes. To the contrary, the truly skillful that sometimes may be difficult to identify during bull markets become much more visible and easy to identify.

That is why when searching for a financial advisor, if you’re committed to the bad idea of going with a Smith Barney, Goldman Sachs, JP Morgan or other big commercial firm advisor, the only advisor you should consider is one that consistently has yielded positive gains during years in which stock markets have lost 15% or more. However, I don’t believe that you will ever find an advisor at any global firm that outperforms markets in down years by 20%, 30% or more. And this is why I always encourage everyone to take accountability for their own money management and to learn on their own what will never be taught about wealth building in academic settings.

I will discuss below, with more charts, why being contrarian is insufficient to consistently yield significant profits and why you must be able to time the markets to return double-digit and triple-digit yields as I did last year. If you were simply contrarian, you would have been invested in PM mining stocks for the entire duration of 2022 as the sentiment was no one can make money in PM mining stocks in 2022. And obviously if you were vested for the entirety of 2022, you would have lost significant amounts of money in PM mining stocks. Thus, were I to label this past investment year, I would name it as “The Year of Timing”, as that was the only strategy that yielded significant profits. And as I stated above it is also likely the only strategy that will yield profits this year and in the next few years as well. What goes into timing a market? I’ll discuss these factors below.

Keep reading with a 7-day free trial

Subscribe to Building Wealth With Tomii Academy to keep reading this post and get 7 days of free access to the full post archives.